WHAT WE DO

Our goal over the next three years is to continue current mining

operations, and discover, acguire and engage in additional full-scale mining

operations in North America. However, this cannot be accomplished

without taking care of other responsibilities as well. Our social

responsibility is paramount working together with government and the

community, and forming successful global alliances, providing economic

growth in the countries we operate in.

As stated above, in addition to its current projects, the Company intends to

discover and acguire land leases on properties known to have gold

deposits. The business will then develop gold mines on these properties

with the intent to extract, smelt, and package the gold into bars for sale

onto the open market.

The capital sought in this business summary will allow the company to

acguire additional land leases with verified gold deposits, while

concurrently sourcing the eguipment needed to continue updating and

operating its gold mining operations. It should be noted that at all times,

the business will comply with all applicable federal, state, and local laws

(including OSHA) in order to ensure the safety of all employees working at

the Gold Mine sites. In addition, to the production of gold, the initial

funding will allow the Company to explore diamonds and tantalum, as well

as, always with a view toward increased profitability.

Our Gold

Mining Operations

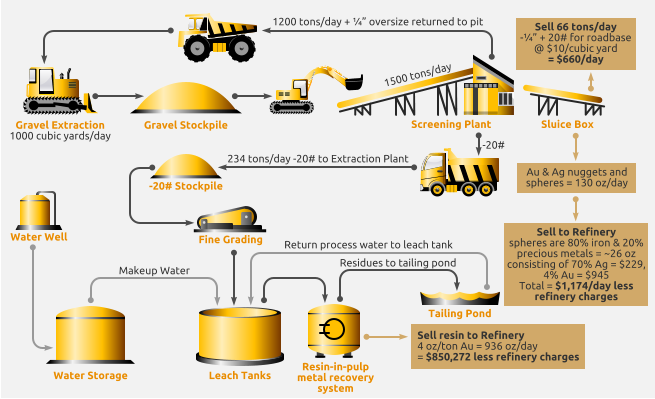

Oicintra, Inc. plans to create a system to process 234 tons of 20 mesh

gravel daily once operating at full capacity. Each leaching circuit operates

independently which allows production to continue even if one line is shut

down for maintenance. The previous testing of samples from the Havasu

Placer Claims mining properties indicates that the minus 20 mesh fraction

accounts for about 10% to 15% of the alluvial material. To achieve this

quantity of concentrate requires that about 400,000 to 500,000 short tons

per year be mined. It is expected that about 90% or more of the contained

gold and silver will be recovered from the complete milling process,

yielding annual revenues of $450 million at current market prices for a

minimum of the next 10 plus years.

Use of Proceeds

5 Year Cash Flow

Projections

Total Mine Operating Expenses

Total General and Administrative Expenses

Capital Expendiures

Contingency

$950,000

$800,000

$6,100,000

$1,000,000

$8,850,000

Year 01

$149,760,00

1,123,200

150,883,200

(927,600)

(756,000)

(6,015,000)

(7,698,600)

$143,184,600

$143,184,600

Revenues

Gold

Silver

Total Revenues

Cash Outflows

Mine Operating Expenses

Administrative Expenses

Capital Expenditures

Net Cash Flow

Cummulative Cash Flow

Year 02

$389,376,000

4,043,520

393,419,520

(2,213,300)

(916,000)

—

(3,129,300)

$390,290,220

$533,474,820

Year 03

$389,376,000

4,043,520

393,419,520

(2,213,300)

(1,005,000)

—

(3,218,300)

$390,201,220

$923,676,040

Year 04

$584,064,000

6,065,280

590,129,280

(3,319,950)

(1,190,000)

(2,200,000)

(6,709,950)

$583,419,330

$1,507,095,370

Year 05

$778,752,000

8,087,040

786,839,040

(4,426,600)

(1,240,000)

(2,200,000)

(7,866,600)

$778,972,440

$2,286,067,810

Copyright © Oicintra, Inc., 2017